Toronto and Etobicoke Real Estate Home Sales for April 2019

Looking for current information on Toronto and Etobicoke Real Estate Home Sales for April 2019? Here are the latest numbers for Home Sales in Toronto and Etobicoke.

GTA REALTORS® Release April 2019 Statistics

Toronto Real Estate Board President Garry Bhaura announced that Greater Toronto Area REALTORS® reported a substantial year-over-year increase in home sales in April 2019. The number of residential transactions jumped by 16.8% to 9,042 compared to 7,744 in April 2018. On a preliminary seasonally adjusted basis, sales were up 11.3% compared to March 2019.

New listings were also up year-over-year by 8%. However, the annual growth rate for new listings was much lower than that reported for sales. This suggests that market conditions continued to tighten which points toward an acceleration in price growth.

“The strong year-over-year growth in sales is obviously a good news story and likely represents some catchup from a slow start to the year. TREB’s sales outlook for 2019 anticipates an increase relative to 2018. It should be noted, however, that growth in new listings is not keeping pace with sales. This points to the ongoing housing supply issue in the GTA. In this regard TREB welcomes the provincial government’s Housing Supply Action Plan announced last week to reduce red tape and improve the mix of housing types. TREB provided input on the Plan through submissions and participation on working groups,” said Mr. Bhaura.

The year-over-year rate of price growth generally edged up in April relative to the first three months of the year. The MLS® HPI Composite benchmark was up by 3.2% – the highest rate of growth in more than a year. The average selling price was up by 1.9% to $820,148, representing the strongest annual rate of growth so far in 2019. On a preliminary seasonally adjusted basis, the average selling price was also up by 1.1% compared to March 2019.

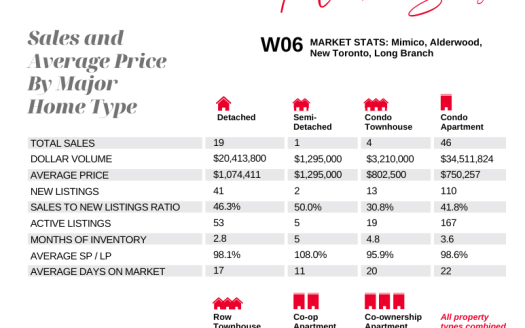

Price growth continued to be driven by the condominium apartment segment and higher-density low-rise segments. The average price for detached houses dipped year-over-year, specifically in regions surrounding the City of Toronto. The detached market segment, with the highest price point on average, has arguably been hardest hit by measures such as the OSFI stress test.

“While sales were up year-over-year in April, it is important to note that they remain well-below April levels for much of the past decade. Many potential home buyers arguably remain on the sidelines as they reassess their options in light of the OSFI-mandated two percentage point stress test on mortgages. Longer term borrowing costs have trended lower this year and the outlook for short-term rates, for which the Bank of Canada holds the lever, is flat to down this year. Unfortunately, against this backdrop, we have seen no movement toward flexibility in the OSFI stress test,” said Jason Mercer, TREB’s Chief Market Analyst.

What does this all mean for you and how do you navigate the Toronto and Etobicoke real estate market if you are thinking about buying or selling?

If you would like up to the minute statistics based on all the homes for sale in your neighbourhood send me a quick email let me know which area you live in and type of home and I’ll send that off to you right away!

If you are looking to buy, just let me know your preferred price range, style of home, wants, needs and area and I’ll send you a list of the best homes that suit your criteria right now!

Part of my job as your Realtor® is to provide you with up to date local market statistics. This way, you are kept in the know about your home’s worth.

You must be logged in to post a comment.